Mortgage Refinance: What It Is, How It Works, Types, and Example

Refinancing your mortgage can be a powerful financial tool to save money, access home equity, or adjust your loan terms. Whether you’re looking to lower your interest rate, shorten your loan term, or tap into your home’s equity, refinancing offers several benefits. However, it’s important to understand the process, requirements, and potential drawbacks before making a decision.In this comprehensive guide, we’ll cover everything you need to know about mortgage refinancing, including:

- The types of refinance options available

- The benefits of refinancing

- The requirements and qualifications needed

- The refinancing process step-by-step

- The costs and fees associated with refinancing

- Strategies for finding the best refinance deal

- Potential pitfalls to avoid

By the end of this article, you’ll have a thorough understanding of mortgage refinancing and be equipped to make an informed decision about whether it’s the right move for your financial situation.

Types of Refinance Options

When it comes to refinancing your mortgage, there are several options to choose from. The most common types of refinance loans include:

Rate-and-Term Refinance

A rate-and-term refinance involves replacing your current mortgage with a new loan that has a different interest rate and/or repayment term. This is the most common type of refinance and is often used to secure a lower interest rate and reduce monthly payments.

Cash-Out Refinance

With a cash-out refinance, you’ll take out a new loan for more than what you currently owe on your home. The difference between the new loan amount and your existing mortgage balance is paid out to you in cash. This option allows you to access your home’s equity for various purposes such as home improvements, debt consolidation, or other financial needs.

FHA Streamline Refinance

An FHA Streamline Refinance is available for homeowners with an existing FHA loan. It offers a faster and simpler refinance process with reduced documentation and often no appraisal required. This option is designed to help FHA borrowers take advantage of lower interest rates without going through a full underwriting process.

VA Interest Rate Reduction Refinance Loan (IRRRL)

Similar to the FHA Streamline Refinance, the VA IRRRL is available for homeowners with an existing VA loan. It allows you to refinance with a lower interest rate and often requires less documentation than a traditional refinance.

ALSO RERAD>>

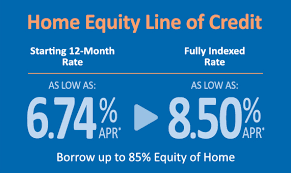

Understanding Mortgage Equity Lines of Credit: A Comprehensive Guide

Jumbo Refinance

A jumbo refinance is used for high-value properties that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. These loans typically have stricter requirements and may require a higher credit score and more equity in the home.

Benefits of Refinancing

Refinancing your mortgage can provide several benefits, depending on your financial goals and current situation. Some of the most common advantages include:

Lower Interest Rate

One of the primary reasons homeowners refinance is to secure a lower interest rate, which can lead to significant savings over the life of the loan. If current rates are lower than your existing mortgage rate, refinancing can reduce your monthly payments and the total interest you’ll pay.

Shorter Loan Term

Refinancing can also allow you to shorten your loan term, such as going from a 30-year mortgage to a 15-year mortgage. While this may result in higher monthly payments, it can help you pay off your home faster and save on interest over the long run.

Access Home Equity

A cash-out refinance enables you to tap into your home’s equity, providing access to funds for home improvements, debt consolidation, or other financial needs. This can be especially beneficial if your home has increased in value since you purchased it.

Remove Private Mortgage Insurance (PMI)

If you’ve built up sufficient equity in your home, refinancing can help you remove private mortgage insurance (PMI) from your monthly payments. PMI is typically required when you have less than 20% equity in your home.

Consolidate Debt

By tapping into your home’s equity through a cash-out refinance, you can use the funds to pay off high-interest debts such as credit cards or personal loans. This can simplify your payments and potentially lower your overall interest costs.

RELATED ARTICLE>>

Life Insurance: A Comprehensive Guide

Complete Guide for “Admiral Car Insurance: All You Need To Know “

Refinance Requirements and Qualifications

To qualify for a mortgage refinance, you’ll need to meet certain requirements set by your lender and the type of loan you’re applying for. Some of the key factors lenders consider include:

Credit Score

Lenders typically require a minimum credit score to refinance, with the exact score varying depending on the loan program. For conventional loans, a credit score of at least 620 is often required, while FHA and VA loans may have lower minimum scores.

Home Equity

Most refinance programs require you to have a certain amount of equity in your home, typically at least 20%. This is expressed as a loan-to-value (LTV) ratio, which compares the amount of your mortgage to the value of your home. A lower LTV ratio (higher equity) generally qualifies you for better rates and terms.

Debt-to-Income (DTI) Ratio

Lenders will evaluate your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income. Most programs have a maximum DTI ratio, often around 43-50%, to ensure you can comfortably afford the new mortgage payment.

Income and Employment

You’ll need to provide documentation of your income and employment, such as pay stubs, W-2s, and tax returns. Lenders want to see a stable source of income and a history of on-time payments.

Closing Costs

Refinancing typically comes with closing costs, which can range from 2-5% of the loan amount. These costs may include appraisal fees, origination fees, and other lender charges. You’ll need to factor these costs into your decision and consider how long it will take to recoup them through monthly savings.

The Refinancing Process

The refinancing process is similar to obtaining your original mortgage, but it’s often faster and simpler. Here’s a step-by-step guide to the refinancing process:

- Determine your goals and research lenders: Start by clearly defining your reasons for refinancing, such as lowering your rate, shortening your term, or accessing equity. Shop around with multiple lenders to compare rates, fees, and customer service.

- Get pre-approved: Complete a loan application with your chosen lender and provide the necessary documentation, such as pay stubs, tax returns, and asset statements. The lender will pull your credit and provide a pre-approval letter.

- Get your home appraised: The lender will order an appraisal to determine the current market value of your home. This is used to calculate your LTV ratio and the amount you can borrow.

- Lock in your interest rate: Once you’ve selected a lender and loan program, you’ll lock in your interest rate to protect against market fluctuations. The lock period typically lasts 30-60 days.

- Complete the underwriting process: The lender will review your application, documentation, and appraisal to verify that you meet all the necessary requirements. This may involve providing additional information or clarification.

- Close on your new loan: If approved, you’ll sign the final paperwork and close on your new mortgage. Be prepared to pay closing costs at this stage, either out-of-pocket or by rolling them into your new loan.

- Make your first payment: After closing, you’ll begin making payments on your new mortgage. Be sure to make any necessary adjustments to your budget to accommodate the new payment amount.

Strategies for Finding the Best Refinance Deal

To get the best possible deal when refinancing your mortgage, consider these strategies:

Shop Around with Multiple Lenders

Don’t settle for the first lender you come across. Shop around with at least three to five lenders to compare rates, fees, and customer service. This can help you find the most competitive offer and potentially save thousands of dollars over the life of the loan.

Negotiate Closing Costs

While closing costs are typically non-negotiable, you may be able to negotiate certain fees or have the lender cover some of the costs. Ask about lender credits or no-cost refinance options, which can help offset the upfront expenses.

Consider Discount Points

Discount points are fees you pay upfront to lower your interest rate. Each point typically costs 1% of the loan amount and can reduce your rate by 0.25%. Paying points may be worthwhile if you plan to stay in your home for an extended period and can recoup the upfront costs through monthly savings.

Time Your Refinance Strategically

The best time to refinance is when interest rates are low and your financial situation is stable. Monitor market trends and consider refinancing when rates are at least 0.75-1% lower than your current mortgage rate.

Factor in the Break-Even Point

The break-even point is the amount of time it takes for your monthly savings to offset the closing costs of refinancing. Calculate this by dividing your closing costs by your monthly savings. If you plan to stay in your home long enough to recoup the costs, refinancing may be worthwhile.

Potential Pitfalls to Avoid

While refinancing can provide significant benefits, there are also some potential drawbacks to be aware of:

Extending Your Loan Term

If you refinance into a new 30-year mortgage, you may end up paying interest for a longer period, even if you’ve been making payments for several years. This can result in paying more interest over the life of the loan.

Resetting the Clock on Your Mortgage

When you refinance, you essentially start a new mortgage. If you’ve been making payments for several years, refinancing can reset the clock on your mortgage, meaning you’ll be paying interest for a longer period.

Closing Costs

Refinancing comes with closing costs, which can range from 2-5% of the loan amount. These upfront expenses can eat into your potential savings, so it’s important to factor them into your decision.

Prepayment Penalties

Some lenders may charge a prepayment penalty if you pay off your mortgage early, such as when refinancing. Be sure to review your current mortgage terms and ask about prepayment penalties before starting the refinance process.

Conclusion

Mortgage refinancing can be a powerful tool to save money, access home equity, or adjust your loan terms. By understanding the different types of refinance options, the requirements and qualifications needed, and the potential benefits and drawbacks, you can make an informed decision about whether refinancing is the right choice for your financial situation.Remember to shop around with multiple lenders, negotiate closing costs, and consider factors such as your break-even point and the length of time you plan to stay in your home. With careful planning and research, refinancing can help you achieve your financial goals and save money over the long term.

How does a cash-out refinance differ from a rate-and-term refinance?

A cash-out refinance and a rate-and-term refinance are two different types of mortgage refinancing options that serve different purposes. Here are the key differences:

Purpose

- Rate-and-term refinance: Focuses on improving the terms of your existing mortgage, such as getting a lower interest rate or changing the loan term.

- Cash-out refinance: Allows you to tap into your home’s equity by taking out a larger loan and receiving the difference in cash.

Loan Amount

- Rate-and-term refinance: The new loan amount matches your current mortgage balance.

- Cash-out refinance: The new loan amount exceeds your current mortgage balance, and you receive the difference in cash.

Interest Rates

- Rate-and-term refinance: Typically has a lower interest rate compared to a cash-out refinance.

- Cash-out refinance: Usually comes with a slightly higher interest rate, as it’s considered a riskier proposition for lenders.

Equity Requirements

- Rate-and-term refinance: Typically requires at least 20% equity in your home.

- Cash-out refinance: Also requires at least 20% equity, but you can access up to 80% of your home’s value in cash.

Credit Score and DTI Requirements

- Rate-and-term refinance: May have slightly less stringent credit score and debt-to-income (DTI) ratio requirements compared to a cash-out refinance.

- Cash-out refinance: Lenders may require a higher credit score and lower DTI ratio to offset the increased risk.

In summary, a rate-and-term refinance is best suited for homeowners who want to improve their loan terms and potentially save money, while a cash-out refinance is ideal for those who need to access their home equity for specific purposes like home improvements, debt consolidation, or other financial needs.