TABLE OF CONTENT

- H2: What is Home Equity Credit?

- H3: Definition and Explanation

- H3: How Home Equity Credit Differs from Other Loans

- H2: How Does Home Equity Work?

- H3: Calculating Home Equity

- H3: Home Equity Line of Credit (HELOC) vs Home Equity Loan

- H2: Types of Home Equity Credit

- H3: Home Equity Loan

- H3: Home Equity Line of Credit (HELOC)

- H2: Key Benefits of Home Equity Credit

- H3: Lower Interest Rates

- H3: Flexible Repayment Options

- H3: Tax Benefits of Home Equity Credit

- H2: Risks Associated with Home Equity Credit

- H3: Potential Foreclosure

- H3: Overborrowing Concerns

- H2: Eligibility Criteria for Home Equity Credit

- H3: Credit Score Requirements

- H3: Loan-to-Value Ratio

- H3: Income and Employment Verification

- H2: How to Apply for Home Equity Credit

- H3: Steps to Apply

- H3: Required Documentation

- H2: How to Use Home Equity Credit Effectively

- H3: Home Renovations

- H3: Debt Consolidation

- H3: Education and Medical Expenses

- H2: Managing Home Equity Credit

- H3: Understanding Repayment Plans

- H3: Interest-Only Periods

- H3: Full Repayment Strategies

- H2: Home Equity Credit vs Other Forms of Borrowing

- H3: Personal Loans

- H3: Credit Cards

- H3: Mortgage Refinancing

- H2: Common Mistakes to Avoid with Home Equity Credit

- H3: Misusing Home Equity

- H3: Ignoring Market Conditions

- H2: Alternatives to Home Equity Credit

- H3: Cash-Out Refinancing

- H3: Personal Loans

- H2: How Economic Factors Affect Home Equity Credit

- H3: Rising Interest Rates

- H3: Property Value Fluctuations

- H2: The Future of Home Equity Credit

- H3: Emerging Trends

- H3: Digital Lending Platforms

- H2: Conclusion

- H2: FAQs

- H3: What is the main difference between a HELOC and a Home Equity Loan?

- H3: Can I use a home equity loan for anything?

- H3: How long does it take to get home equity credit?

- H3: What are the risks of using home equity for investments?

- H3: How can I improve my chances of getting approved for home equity credit?

Understanding Home Equity Credit

Home equity credit is an essential financial tool that many homeowners leverage to finance various life goals, from home renovations to debt consolidation. But what exactly is home equity credit, and how does it work? In this article, we’ll explore home equity credit in detail, discussing its benefits, risks, and how to use it effectively.

What is Home Equity Credit?

Definition and Explanation

Home equity credit is a type of loan or line of credit that allows homeowners to borrow money using the equity they’ve built up in their homes. Equity is the difference between the current market value of your home and the outstanding balance on your mortgage. For example, if your home is worth $300,000 and you still owe $200,000 on your mortgage, you have $100,000 in equity. Home equity credit enables you to tap into this equity to access funds when needed.

How Home Equity Credit Differs from Other Loans

Unlike personal loans or credit cards, home equity credit is secured by your home, meaning the lender uses your home as collateral. This security typically results in lower interest rates compared to unsecured loans. However, the major risk is that if you fail to repay, you could lose your home to foreclosure.

How Does Home Equity Work?

Calculating Home Equity

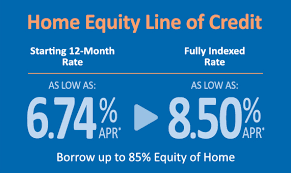

To calculate your home equity, subtract your outstanding mortgage balance from the current market value of your home. The result is your available equity. Lenders typically allow homeowners to borrow up to 85% of this equity, though specific terms vary depending on the lender and your credit profile.

Home Equity Line of Credit (HELOC) vs Home Equity Loan

Home equity credit generally comes in two forms: the Home Equity Line of Credit (HELOC) and the Home Equity Loan. A HELOC works like a credit card; you can borrow money as needed up to a certain limit during a draw period, and only pay interest on what you borrow. A home equity loan, on the other hand, provides a lump sum with fixed interest rates and a set repayment period.

Types of Home Equity Credit

Home Equity Loan

A home equity loan is a lump sum of money you borrow against your home’s equity. It usually comes with a fixed interest rate and a set repayment schedule, making it ideal for large expenses like home renovations or paying off high-interest debt.

Home Equity Line of Credit (HELOC)

A HELOC allows you to borrow money as needed up to a certain limit, similar to a credit card. It offers more flexibility, with variable interest rates and interest-only payment options during the draw period, which typically lasts around 10 years.

Key Benefits of Home Equity Credit

Lower Interest Rates

One of the main advantages of home equity credit is the lower interest rates compared to personal loans or credit cards. Since the loan is secured by your home, lenders offer more favorable terms.

Flexible Repayment Options

Home equity credit offers various repayment options. HELOCs often provide an interest-only period during which you only pay interest on the money borrowed, giving you flexibility in managing your payments.

Tax Benefits of Home Equity Credit

In many cases, the interest paid on home equity loans or HELOCs may be tax-deductible if the funds are used for home improvements. However, it’s important to consult with a tax advisor for the most current guidelines.

Risks Associated with Home Equity Credit

Potential Foreclosure

Since your home serves as collateral, failing to repay the loan could result in foreclosure. This is a significant risk that should be carefully considered before borrowing against your home.

Overborrowing Concerns

Borrowing too much against your home can lead to financial strain, especially if home values drop, leaving you with negative equity. Always borrow responsibly and avoid overextending your finances.

Eligibility Criteria for Home Equity Credit

Credit Score Requirements

Lenders typically require a good credit score to approve home equity credit. While the exact score varies by lender, a score of 620 or higher is often necessary.

Loan-to-Value Ratio

Your loan-to-value (LTV) ratio, which compares your outstanding mortgage to the value of your home, plays a significant role in determining your eligibility. Most lenders prefer an LTV of 80% or lower.

Income and Employment Verification

Lenders also consider your income and employment history when approving home equity credit. Proof of stable income ensures you can handle monthly payments.

How to Apply for Home Equity Credit

Steps to Apply

To apply for home equity credit, start by checking your credit score and LTV ratio. Then, gather documentation such as proof of income, tax returns, and details about your current mortgage. Finally, shop around for the best lender and submit your application.

Required Documentation

Common documents needed for application include:

- Proof of income (pay stubs, tax returns)

- Mortgage statements

- Home appraisal

- Identification documents

How to Use Home Equity Credit Effectively

Home Renovations

One of the most popular uses of home equity credit is for home improvements, which can increase the value of your property.

Debt Consolidation

Home equity credit is often used to consolidate high-interest debt into one, lower-interest payment, making it easier to manage.

Education and Medical Expenses

Some homeowners use home equity credit to fund major expenses like education or medical bills. However, it’s important to weigh the risks and benefits of using your home as collateral for non-property-related expenses.

Managing Home Equity Credit

Understanding Repayment Plans

It’s crucial to understand the repayment terms of your home equity loan or HELOC. Ensure that you know whether you’re in an interest-only period or if full repayments are required.

Interest-Only Periods

Some HELOCs offer an interest-only period during the draw phase. While this lowers monthly payments initially, it can lead to higher payments later when the repayment period starts.

Full Repayment Strategies

If you’re nearing the end of a draw period, plan how to repay the loan fully. Make sure your budget can handle the transition from interest-only payments to full repayment.

Home Equity Credit vs Other Forms of Borrowing

Personal Loans

Unlike home equity credit, personal loans are unsecured, often carrying higher interest rates but without the risk of losing your home if you default.

Credit Cards

Credit cards have higher interest rates than home equity loans or HELOCs, but they offer the convenience of revolving credit without using your home as collateral.

Mortgage Refinancing

Refinancing replaces your existing mortgage with a new one, potentially at a lower interest rate. While similar to a home equity loan, refinancing changes your entire mortgage rather than creating a separate loan.

Common Mistakes to Avoid with Home Equity Credit

Misusing Home Equity

Avoid using home equity for frivolous expenses or speculative investments. The stakes are high when your home is on the line.

Ignoring Market Conditions

Pay attention to the housing market. A drop in home values could reduce your available equity and make repayment more difficult.

Alternatives to Home Equity Credit

Cash-Out Refinancing

With cash-out refinancing, you refinance your mortgage for more than you owe, receiving the difference in cash. This option may be better if you want to restructure your entire mortgage rather than taking out a new loan.

Personal Loans

Personal loans can be a viable alternative if you need smaller amounts of money without putting your home at risk.

How Economic Factors Affect Home Equity Credit

Rising Interest Rates

Higher interest rates can make home equity loans and HELOCs more expensive. Monitor economic trends to time your application when rates are favorable.

Property Value Fluctuations

A drop in property values can reduce your equity, limiting your borrowing power and increasing the risk of negative equity.

The Future of Home Equity Credit

Emerging Trends

The future of home equity credit may include more flexible lending terms, such as digital platforms offering faster approvals and innovative financial products.

Digital Lending Platforms

As technology advances, digital platforms are simplifying the process of applying for home equity credit, making it easier and more accessible for homeowners.

Conclusion

Home equity credit can be a valuable financial resource when used responsibly. Whether you need to make home improvements, consolidate debt, or cover major expenses, understanding how home equity works and its associated risks is essential. Make sure to evaluate your financial situation, research lenders, and use this credit wisely.

FAQs

What is the main difference between a HELOC and a Home Equity Loan?

A HELOC is a revolving line of credit with variable interest rates, while a home equity loan is a lump sum with fixed interest rates.

Can I use a home equity loan for anything?

Yes, but it’s recommended to use it for major expenses like home renovations, education, or debt consolidation to maximize its value.

How long does it take to get home equity credit?

The process typically takes between 2 and 6 weeks, depending on the lender and your financial profile.

What are the risks of using home equity for investments?

Investing borrowed money from your home can be risky, especially if the investment doesn’t pay off. You risk losing your home if you default on payments.

How can I improve my chances of getting approved for home equity credit?

Improving your credit score, lowering your debt-to-income ratio, and maintaining a low loan-to-value ratio can enhance your approval chances.